Infographic by Visa

The just-released findings of a survey by Visa on the impact of COVID-19 pandemic reveal the payment behaviour of consumers in the UAE. The study also looks at consumers’ general views, preferences and concerns related to digital payments and offer vital insights for merchants.

The survey release corresponds with the launch of Visa’s fifth annual “Stay Secure” social media campaign on Facebook and Instagram to promote safe digital payment practices.

This year’s campaign, in partnership with Dubai Police and Dubai Economy, comes at a time when more consumers in the UAE have increased their use of digital payments, and many opting to shop online for the first time to get what they need during this health crisis. The Stay Secure webpage offers tips and educational videos, and information on security features of digital payments.

COVID-19 impact on shopping and payment behaviour

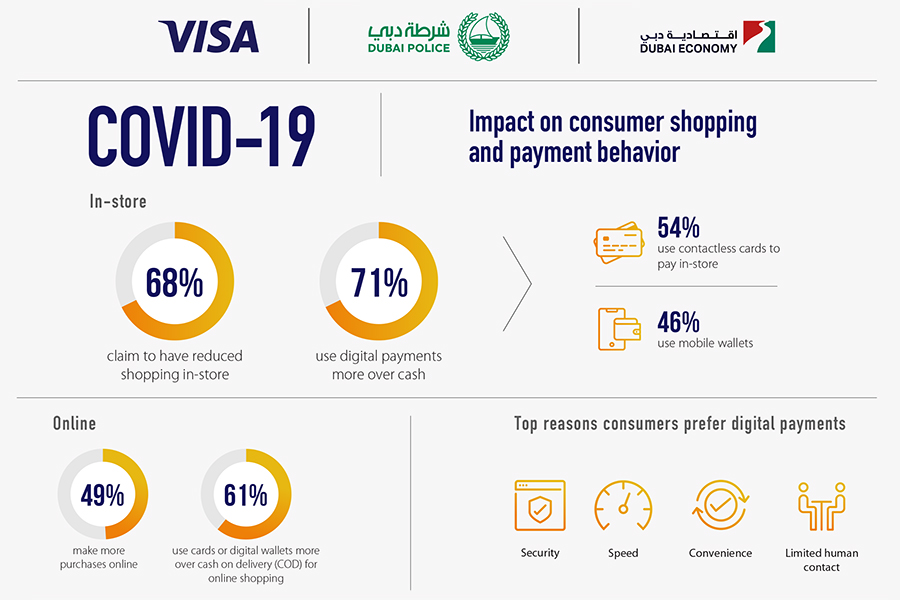

Of the respondents surveyed in the UAE, 68% have reduced shopping in-store since the outbreak of the pandemic, and 49% are shopping online more. When they do shop at stores, 71% are using digital payments over cash with the majority using contactless cards (54%) and mobile wallets (46%) more. For respondents shopping more online, the majority (61%) use cards or digital wallets more to pay online over COD. Increased trust in the security of the payment technology, speed, convenience, and limited human contact were the top reasons cited for their increased preference for digital payments.

“Combatting cybercrime by raising awareness and vigilance among UAE residents, is a unified goal across all our government entities. Dubai Police is pleased to partner with Visa and Dubai Economy on the Stay Secure initiative. It not only helps amplify our efforts on reducing fraud and cybercrime in the UAE but also echoes our recent National Fraud Awareness campaign to address this threat,” says Brigadier Jamal Salem Al Jalaf, director of criminal investigation department, Dubai Police.

“The study shows that consumer behaviour changes due to the pandemic – such as shifting online and increasing use of digital payments, are likely to continue even after the pandemic – an important take-away for businesses developing strategies for the post-COVID-19 consumer and market overall. Dubai Economy has been promoting online shopping and contactless payments not only to ensure safe shopping during the COVID-19 crisis but also as part of our larger goal of accelerating the digital transformation of economic activity, particularly retailing, in Dubai. We are pleased to partner with Visa and Dubai Police on the ’Stay Secure’ campaign – a much needed and timely initiative,” says Mohammed Ali Rashed Lootah, CEO of commercial compliance & consumer protection (CCCP) sector, Dubai Economy.

“The pandemic has changed how consumers shop and pay with increased reliance on and preference for digital commerce. With increased usage both among experienced and first-time users, cyber criminals too are keen to capitalise on the increased activity and vulnerability, especially of first-time online shoppers. We are delighted to partner with Dubai Police and Dubai Economy to continue our mission of empowering consumers to continue using digital payments and online channels with full confidence,” says Neil Fernandes, Visa’s head of risk for MENA.