Dubai-headquartered investment banking advisory firm, Alpen Capital (ME) Limited, announced the publication of its report on GCC Retail Industry for the year 2019. The report provides a comprehensive overview of the GCC retail sector and outlines the recent trends, growth drivers and challenges in the sector.

“The GCC retail industry has witnessed challenging times in recent years but the long-term fundamentals of the sector remain intact,” says Sameena Ahmad, managing director, Alpen Capital (ME) Limited. “We anticipate the GCC retail sector to regain momentum, owing to strong fundamentals that include a growing population base, high GDP per capita and tourism growth in the region. Economic recovery led by improving oil prices is expected to revive consumer confidence and improve discretionary spending. Initiatives taken by the GCC governments to stimulate retail infrastructure projects and ease business and visa regulations should provide further impetus to the retail sector.”

Krishna Dhanak, executive director at Alpen Capital, while presenting the report, says the changing consumer preferences and the rising adoption of e-commerce platforms are transforming the region’s retail landscape. “Although challenges remain due to the current economic factors, we anticipate that the sector will see growth over the next five years. Initiatives taken by the GCC governments to stimulate retail infrastructure projects and ease business and visa regulations should provide impetus to the retail sector. We saw several intra-regional and cross border M&A transactions with a significant focus on e-commerce/online retailing space in the last two years. We expect to see continuing activity in the M&A sphere as retail companies look for new opportunities for expanding their market base and size.”

Industry outlook

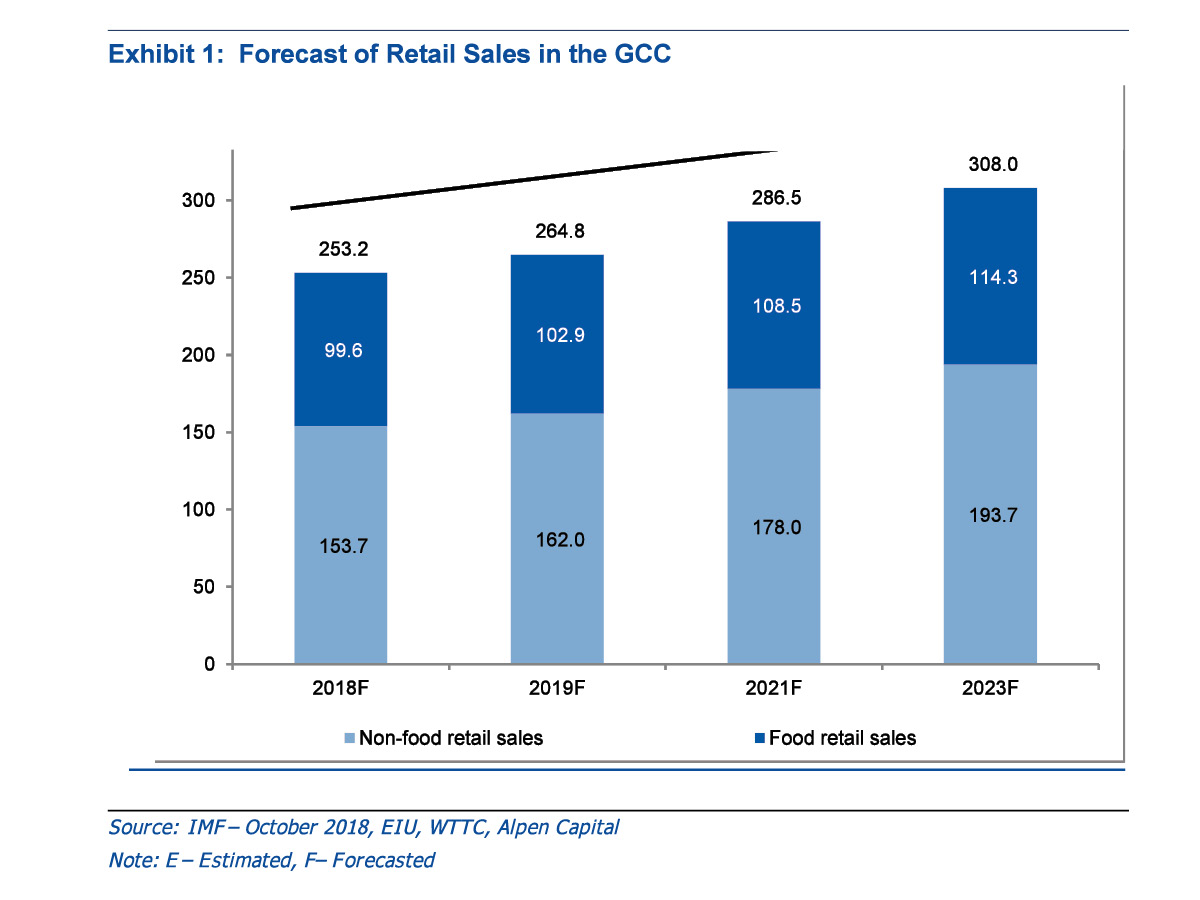

The size of the GCC retail sector, according to Alpen Capital, is forecast to grow at a CAGR of 4% from $253.2 billion in 2018 to $308 billion in 2023. Retail sales were under pressure in the recent years but are expected to recover and grow through 2023. The major drivers of growth in retail sales are increasing population, GDP per capita growth and an evolving tourism landscape. It is expected to be further aided by the recovery of oil prices improving the macroeconomic stability and targeted government initiatives such as reviving infrastructure projects, allowing 100% foreign ownership in retail sector and ease in visa regulations for tourist arrivals. Additionally, the upcoming mega events in the region will further propel the growth in retail sales.

The retail sector is undergoing significant changes with the emergence of e-commerce across the GCC countries. The rise in the number of millennials, working women and expatriate population is driving demand for consumer goods, especially international branded products and global food concepts. Consequently, the non-food retail sales are anticipated to grow at an annualised average of 4.7% between 2018 and 2023, while food retail sales are expected to increase at a CAGR of 2.8% during the forecast period.

Country-wise retail sales

During the forecast period, the annualised growth in retail sales in the GCC states is projected to range between 2.2% and 5.1%. The UAE, Kuwait and Qatar are expected to record faster growth driven mainly by increase in tourism activity, GDP per capita and penetration of organised retail stores. The UAE and Saudi Arabia are expected to continue to dominate the retail sales in the region, cumulatively accounting for 76.9% of the total retail sales in 2023.

Duty free sales

Duty free sales at the Dubai, Abu Dhabi, Doha and Bahrain airports are projected to reach $4.8 billion by 2023, implying an annualised growth of 8.8% from 2018. The strong growth could be attributed to an anticipated rise in passenger traffic due to mega events such as World Expo 2020 and the FIFA World Cup 2022. Moreover, the region also has a wide gamut of attractions to offer to international travellers across various sectors such as leisure & entertainment, sports, festivals and MICE (Meetings, Incentives, Conferences, and Exhibitions).

Luxury retail sales

Retail sales of personal luxury goods in the Middle East, primarily led by the GCC states, are forecast to grow at an annualised rate of 4% during the five-year period. The recovery in oil prices and the subsequent economic revival is expected to lead to growth in GDP per capita, consumer spending power and increase in tourist arrivals. These factors, coupled with the initiatives taken by the GCC governments to crack down on counterfeit products, will drive demand of luxury products across the region.

Oversupply of GLA

At 80% completion of projected additions to the retail space, 56 million sqft of retail space is likely to come up in the GCC in the five years to 2023, taking the total organised retail GLA to 219.5 million sqft, which may create an oversupply situation.