Today’s multi-channel shopper is, reportedly, fuelling a wave of digital disruption that threatens to put nearly half of retailer leaders out of business if they don’t transform themselves digitally.

A new research report by Cisco titled ‘Reinventing Retail: Cisco Reveals How Stores Can Surge Ahead on the Digital Transformation Journey’ reveals that despite the risks, retailers around the world are moving too slowly when it comes to digital transformation and may not be investing in the right places. The holiday season’s choppy sales report and the recent closing of big box stores is just the beginning.

“The shakeup caused by digital disruption is already underway with many major retailers announcing the closure of hundreds of their bricks-and-mortar stores in recent months, in order to better compete in a landscape where physical and digital channels are increasingly converging,” says Mike Weston, vice president, Cisco Middle East.

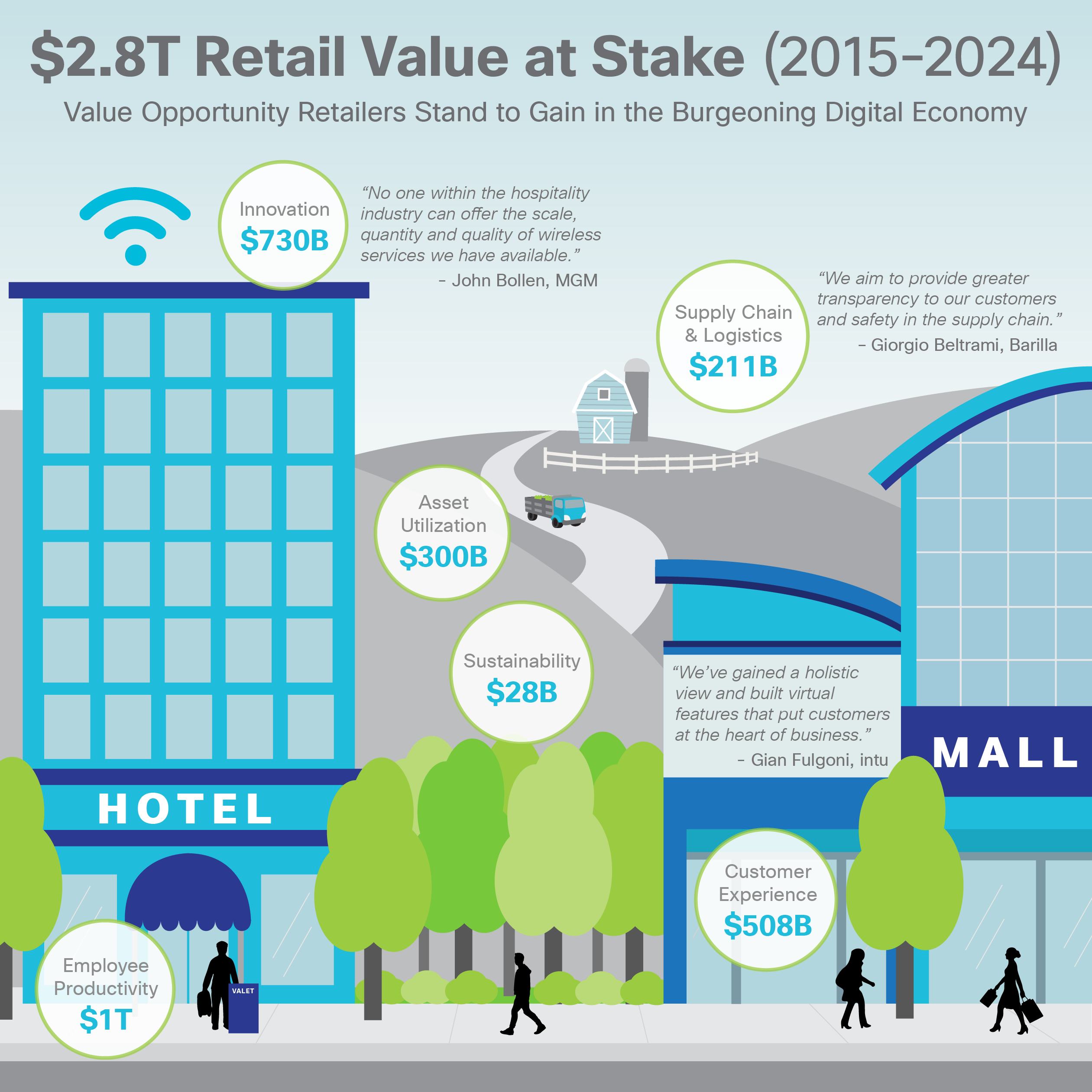

“Yet, there remains a tremendous opportunity, with the potential for retailers to generate more than $506 billion in value that can be achieved through digital transformation. Retailers need to make more progress in digitising their workforce and their core operations in order to execute on the innovative customer experiences they want to deliver, and to position themselves for success in the new retail landscape,” he adds.

In an effort to help retailers achieve digital transformation, Cisco previously released a report titled ‘A Roadmap to Digital Value in the Retail Industry’, which guides retailers through three phases: enable digital capabilities, differentiate their brand through new digital capabilities and define new business models through digital disruption.

Key highlights from that report include:

Some sub-segments of the retail industry are making more progress on their path to digital transformation than others. New York-based apparel manufacturers and garment industry retailers have placed 58% of their digital investment priorities within the differentiate and define phases of the roadmap, compared with just 39% from the bricks-and-mortar retailers, department stores and food service retailers that Cisco spoke with in the southern region of the US.

Retailers in South America are prioritising more of their technology investments in the earliest, enable phase of the roadmap (67%) compared with their counterparts in North America (51%), indicating that South American retailers have not made as much progress in transforming themselves digitally. This may be due to economic conditions in South America causing retailers there to invest first in digitisation of facilities, energy and other operational functions that help lower costs and free up capital.