Data and market research firm, Nielsen Global Connect predicts that holiday season spending will differ depending upon the evolving consumer groups as their shopping behavior resets based on their spending preferences and physical restrictions.

Previously, consumer confidence in the Africa and Middle east region dropped to 93 in Q2 2020 1 – a seven points decline from Q4 2019. Both UAE and Saudi Arabia declined from Q4 2019 versus Q2 2020. In UAE it dropped 19 points, going from 110 to 92 points and in Saudi Arabia it decreased from 119 points to 104. Confidence rollout is

underscored by job prospects which are also facing a decline from 46% in Q4 2019 down to 39% in Q2 2020 for

the region. Given these financial challenges and circumstances, the last quarter of this year holds a crucial opportunity to witness revival from consumer spending on account of festive season.

“As the end of the year approaches, upcoming festivities are going to look very different for consumers depending on where they live, what restrictions they face and how COVID-19 has changed their spending habits. However, the reality is that the ‘golden quarter’ which is consider the crucial holiday trading period is already underway and with the continued spread of the virus and ongoing restrictions, this year’s festive period will be unlike any

other,” says Andrey Dvoychenkov, Nielsen Global Connect Retail Intelligence lead for Arabian Peninsula.

EVOLVING CONSUMER GROUPS

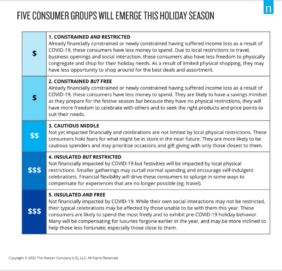

Against this backdrop Nielsen has identified five different consumer groups that indicate how financial and physical restrictions could manifest leading up to the festive season.

1. Constrained and Restricted consumers have suffered income loss as a result of COVID-19 and have less money to spend and also have less freedom to physically congregate and shop for their holiday needs due to local restrictions to travel, business openings and social interaction. As a result of limited physical shopping, they may have less opportunity to shop around for the best deals and assortment.

2. Constrained but Free consumers have also suffered income loss and are likely to have a savings mindset as they prepare for the festive season but because they have no physical restrictions, they will have more freedom to celebrate with others and to seek the right products and price points to suit their needs.

3. Cautious Middle consumers have not yet been impacted financially and their celebrations are not limited by local physical restrictions. They are more likely to be cautious spenders and may prioritise occasions and gift giving with only those closest to them.

4. Insulated but Restricted consumers have not been financially impacted by COVID-19 but festivities will be impacted by local physical restrictions. Smaller gatherings may curtail normal spending and encourage self-indulgent celebrations. Financial flexibility will drive these consumers to splurge in some ways to compensate for experiences that are no longer possible (e.g. travel).

5. Insulated and Free consumers have also not been financially impacted by COVID-19. While their social interactions may not be restricted, their typical celebrations may be affected by those unable to be with them this year. These consumers are likely to spend the most freely and to exhibit pre-COVID-19 holiday behaviour.

In Africa and the Middle East, 76% of constrained consumers opt for omni shopping while insulated consumers are at 73%. Additionally, 43% of constrained consumers actively look for prices and promotions in-store while 51% seek online. While when it comes to insulated consumers, 44% seek for prices and promotions in-store and 49% search online. When it comes to physical shopping, we see sharp declines with 26% of insulated consumers and 24% of constrained consumers 2 . COVID-19-driven online shopping and purchasing behaviors will become ingrained among consumers who opt to avoid regular travel (to stores), and frequent physical touchpoints. For constrained consumers, online channels serve a broader purpose: They are an essential way to research, compare prices and hunt for the right deals before deciding whether to leave home to make the purchase at a physical store or buy it online.

You must be logged in to post a comment.